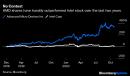

(Bloomberg Opinion) — Not only is business booming for Advanced Micro Devices Inc. The chip giant now even has the swagger to pull off a megadeal without breaking a sweat as it extends its lead over rival Intel Corp.AMD on Tuesday posted better-than-expected third-quarter results and raised its revenue guidance for the current quarter, while also announcing a definitive agreement to acquire Xilinx Inc. for $35 billion in an all-stock deal, one of the biggest of the year. On an call with investors, AMD CEO Lisa Su said the takeover will enable the company to sell more of its chips to the aerospace-defense, industrial and telecommunications markets, where Xilinx has strong customer relationships.The Xilinx purchase had been the topic of recent speculation, so it didn’t come as a huge surprise. Rather, the biggest takeaway in AMD’s news is the vast difference between its quarterly numbers and Intel’s latest results. Both semiconductor giants’ primary business is making central processing unit (CPU) chips that serve as the general-purpose operating brains for desktop and server computers. I’ve written before about how AMD’s latest chip designs offer much better performance while consuming less energy than Intel’s offerings. Last week, when Intel blamed the subdued economy for its poor sales in the data-center and server markets, I was skeptical. My hunch was that AMD was grabbing market share at its competitor’s expense. That appears to be exactly what happened. To illustrate, AMD’s sales rose 56% in its September quarter from a year earlier, while revenue at Intel fell 4%. And in contrast to Intel’s commentary, AMD said its data-center business was strong and reported record server chip sales that more than doubled year over year. Clearly, AMD’s share gains against Intel are accelerating.The problem for Intel is this trend will not end soon. Earlier this month, AMD announced its Ryzen 5000 series, available next month, which offers another big step-up in performance. The new products will likely only add to the share shift toward AMD. What’s more, as a result of Intel’s repeated delays in moving to new chip manufacturing technologies, the company won’t be able to match AMD’s chip capabilities until 2023 at the earliest. Even that timeline assumes that current projections won’t be postponed again, which, given Intel’s recent poor track record, is by no means guaranteed. I’m still not wild about AMD’s acquisition of Xilinx because it may be a potential distraction to management. But the deal won’t change the chipmaker’s unquestioned technological leadership over Intel or the current competitive dynamic. AMD is just getting started.This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.Tae Kim is a Bloomberg Opinion columnist covering technology. He previously covered technology for Barron’s, following an earlier career as an equity analyst.For more articles like this, please visit us at bloomberg.com/opinionSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,