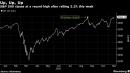

(Bloomberg) — Asian stocks looked poised to gain amid positive sentiment on trade in the region and after a national U.S. lockdown was ruled out. The yen dipped.Asia Pacific nations including China, Japan and South Korea on Sunday signed the world’s largest regional free-trade agreement. Meanwhile, advisers to President-elect Joe Biden said they opposed a nationwide U.S. lockdown despite the pandemic accelerating, favoring targeted local measures instead.On Friday, both the S&P 500 and the Russell 2000 Index of small caps rallied to all-time highs. The tech-heavy Nasdaq 100 underperformed amid the rotation to economically sensitive industries. Ten-year Treasury yields ended the week at 0.9%. The pound dipped as barriers remain to reaching a trade deal in Brexit talks.Global stocks have recovered to pre-pandemic highs after optimism about a vaccine last week drove a rotation into value and cyclical sectors, and more defensive industries underperformed. Still, concerns about a sustainable economic recovery persist amid a flare-up in cases around the world.U.S. coronavirus cases hit a record Friday and neared 11 million infections after new cases exceeded 100,000 for 10 straight days. Germany must live with “considerable restrictions” against the spread of Covid-19 for at least the next four to five months, the country’s economy minister said.“There is certainly elevated chatter that potential shutdowns in the U.S. will weigh more in the near-term and maybe so, but investor sentiment is the most elevated since 2017,” Chris Weston, head of research at Pepperstone Group Ltd., said in a note.The Asia Pacific trade agreement encompasses a third of the world’s population and gross domestic product. It includes Australia, New Zealand and the 10 members of the Association of Southeast Asian Nations inked the Regional Comprehensive Economic Partnership, or RCEP.Elsewhere, Donald Trump showed few signs of conceding the presidential election to Joe Biden, while also hardly acting as if he was preparing for a second term.Here are some events to watch out for this week:China October industrial production, retail sales due Monday.Brexit talks look set to continue as the U.K. and EU approach the latest deadline.Bloomberg New Economy Forum virtually convenes global leaders to discuss trade, growing political populism, climate change, and the pandemic. Former Federal Reserve Chair Janet Yellen, and Indian Prime Minister Narendra Modi are among the many speakers. Through Nov. 19.OPEC+ Joint Ministerial Monitoring Committee meets Tuesday.U.S. retail sales due Tuesday.Bank Indonesia rate decision Thursday.These are some of the main moves in markets:StocksThe S&P 500 gained 1.4% Friday.Nikkei 225 futures rose 1.1% earlier.Futures on the S&P/ASX 200 Index rose 0.8% earlier.Hang Seng Index future gained 0.4% earlier.CurrenciesThe yen dipped 0.1% to 104.74 per dollar.The offshore yuan was at 6.6021 per dollar.The euro advanced 0.1% to $1.1843.The pound fell 0.1% to $1.3181.BondsThe yield on 10-year Treasuries advanced one basis point to 0.90%.CommoditiesWest Texas Intermediate crude fell 2.4% to $40.13 a barrel Friday.Gold rose 0.7% to $1,889.20 an ounce.For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,