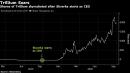

(Bloomberg) — When Jan Skvarka joined biotechnology firm Trillium Therapeutics Inc. as chief executive officer, he made a big bet to reshape the company and went all-in on a cancer treatment platform. Now, he’s reaping the rewards.It was the gamble of a lifetime for the 53-year-old CEO, who decided to shutter the drug developer’s lead program on treating tumors directly and instead focus on cancer-fighting technology for patients with different blood cancers. Investors cheered, rewarding him with a 3,600% stock-surge since he joined the company a year ago.Trillium is the No. 1 stock on Canada’s S&P/TSX Composite Index this year, skyrocketing past tech behemoth Shopify Inc. by almost 10-fold. It’s U.S.-listed shares are the fourth best-performing company on the Nasdaq Composite Index.Despite its epic stock-market rally, every analyst covering the company rates it a buy, signaling that further gains are on the horizon for investors that missed out on Trillium’s initial boom. Wall Street has an average 12-month share price target of $17.58, implying gains of about 30% over the coming year, data compiled by Bloomberg show. Trillium’s shares closed trading at $13.55 on Tuesday.“We need to walk before we run, but if you ask me what our ultimate aspirations are, it’s to challenge chemotherapy,” Skvarka, a former partner of Bain & Co. and Harvard Business School graduate, said by phone.The rebirth of Cambridge, Massachusetts-based Trillium attracted a who’s who of health-focused hedge funds and snagged a $25 million investment from industry giant Pfizer Inc. For Skvarka, who celebrated the anniversary of his first year last weekend, the decision to restructure the company and focus on a newer cancer technology has transformed the drugmaker into a firm with a market cap of about $1.3 billion. Last Halloween, it had a value of a mere $7 million.Some of the hedge funds that have invested in the company, like Millennium Management LLC and Avoro Capital Advisors, have cashed in on part of the year’s gains, while others including Ghost Tree Capital LLC have piled onto their positions.Trillium, like many drug-developing peers that are focused on cancer therapies, is looking to improve on current treatment options and help patients live longer lives.“It’s a very exciting time,” Skvarka said. “We are squarely out of the realm of preclinical data and in the realm of clinical data.”M&A Target?Those aspirations are where the company’s cancer medicines, TTI-621 and TTI-622, come in. The pair of programs, which have shown promising results in early stage studies, are in an emerging class of cancer-fighting technologies that triggered Gilead Sciences Inc.’s $4.9 billion takeout of peer Forty Seven Inc. earlier this year. That deal has sparked speculation that Trillium could be among the next group of companies snatched up by bigger players amid the industry’s rush of deals.While Skvarka wouldn’t comment on whether the company has been approached about a sale, he said that Trillium’s goal is to keep its options open for the time being.“The way we struck the Pfizer deal was very important for us as it kept our optionality open” for the future, he said. “I am a big believer of optionality and having as many options as possible. The options for us are to continue alone or strike a global partnership potentially a way down the road.”For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,