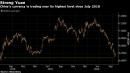

(Bloomberg) — Investors wondering how China plans to evolve its financial markets in the coming years need look no further than the commentary from the weekend’s Bund Summit in Shanghai for guidance.People’s Bank of China Governor Yi Gang said that promoting broader use of the yuan will continue alongside the opening of financial markets. “The regulator’s main job is to reduce restrictions on the cross-border use of the currency, and let it take its own course,” he said.Those comments were echoed by Zhu Jun, director general of the central bank’s international division. Policy makers will remove obstacles that stand in the way of broader use of the currency with steady liberalization of the capital account, increasing yuan exchange-rate flexibility and improving liquidity in the bond market, she said.The comments by the two officials are a reminder that even though promoting use of the yuan hasn’t taken off as rapidly as expected since the idea was kicked off a decade ago, monetary officials are pressing ahead anyway. Success would give Chinese policy makers some things they’ve long dreamed about: the use of the yuan as a global reserve currency and a challenge to the greenback’s dominance in trade and finance.“China will stick to its goal of yuan internationalization and there is no going back from its financial opening up,” said Gao Qi, a strategist at Scotiabank in Singapore. “More and better policies are likely to be seen to accelerate the internationalization.”Chinese policy makers set their plan to raise the influence of their currency in the wake of the global credit crisis but it has made halting progress at best, mostly because the ruling Communist Party has little appetite for giving up control on issues such as capital outflows. Calls for expanding yuan usage picked up in the Asian nation over the past summer as tensions with the U.S. spilled over into the financial sphere.The yuan’s share in global payments and in central bank reserves remains at around 2% but China’s efforts continue. The PBOC said last Thursday that it and Bank of Korea agreed to extend a currency swap agreement another five years and boost the amount involved to 400 billion yuan ($59.9 billion).The yuan has rallied 7.2% from a low in May to its highest in two years. Investor sentiment has gotten a boost from China’s economic rebound from the damage the virus did earlier in the year and the greenback’s weakness. The surge is also being propelled by a wide interest-rate premium over the rest of the world, and by polls that indicate Joe Biden leads Donald Trump in the U.S. presidential contest on Nov. 3.Chinese authorities have taken steps to slow the ascent by setting the daily fixing weaker than market watchers expect and by eliminating a rule that made it expensive to bet against the yuan.The yuan traded little changed at 6.6893 a dollar on Monday, as a major meeting of the Communist Party started in Beijing. That gathering will map out China’s next phase of economic development, an agenda that is partly determined by the leadership’s desire to protect the nation from more friction with the U.S.“Given how Sino-U.S. tensions have spiked over the past three years, there’s probably a deep worry amongst Chinese officials of a bifurcation in global trade so this may hasten the need to open up the yuan,” said Jian Hui Tan, a foreign-exchange strategist at Informa Globalmarkets (S) Pte Ltd.For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,