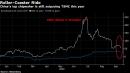

(Bloomberg) — Semiconductor Manufacturing International Corp. retreated to a four-month low in Hong Kong after the U.S. imposed export restrictions on China’s largest chipmaker.The shares slumped as much as 7.9% on Monday, adding to their 25% loss for the month. Also listed in Shanghai, SMIC’s stock there retreated as much as 5.8% to the lowest level since its July debut. U.S. firms must now apply for a license to export certain products to the chipmaker, the Commerce Dept. said in a letter dated Sept. 25, reviewed by Bloomberg News. SMIC and its subsidiaries present “an unacceptable risk of diversion to a military end use,” the department’s Bureau of Industry and Security wrote.Read more: U.S. Imposes Restrictions on Exports to China’s Top ChipmakerThe U.S. stopped short of placing SMIC on the so-called entity list, which means the restrictions are not yet as severe as those imposed on China’s Huawei Technologies Co. Still, the ruling against the chipmaker marks a further escalation in the tensions between the world’s two most powerful countries that have already ensnared other Chinese tech companies including ByteDance Ltd. and Tencent Holdings Ltd.“The restriction, once implemented, will severely damage SMIC’s existing and future manufacturing capabilities, and customer trust,” Bernstein analysts led by Mark Li wrote in a note. “Without steady supply and service from the U.S., the yield and quality of SMIC’s capacity will degrade, as early as in a few months for more advanced nodes.”SMIC has not received an official notice of the sanctions, has no relationship with the Chinese armed forces and does not manufacture goods for any military end-users or uses, the Shanghai-based company said in an emailed statement over the weekend. The Chinese Foreign Ministry in Beijing didn’t immediate respond Monday to a request for comment on the latest U.S. export restrictions.The SMIC ruling was a compromise between the Departments of Defense and Commerce and moderates in the Trump administration, according to one person familiar with the negotiations. The U.S. has reportedly said it was mulling a more severe blacklisting on SMIC — akin to the ones imposed on Huawei — that would affect exports from a broader set of companies.“If SMIC is not included in the Entity List, this could merely be confirmation of the rule change announced on April 27 for ‘civilian end-users’ in U.S.-unfriendly countries,” Jefferies analyst Edison Lee wrote in a note. “Instead of a blanket ban, the U.S. will have sole discretion on what US companies can sell to SMIC.” The brokerage had previously estimated that as much as 50% of SMIC’s equipment is from the U.S.A formal statement that includes details of the restriction may be released by the U.S. Commerce Department Monday, Citigroup said. There will be a comment period of 30 days before the ruling takes effect, with semiconductor equipment companies and industry groups expected to push back against the restrictions, analysts including Atif Malik wrote in a note.For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,