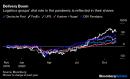

(Bloomberg Opinion) — In normal times, globe-spanning logistics groups such as Deutsche Post AG, FedEx Corp. and United Parcel Service Inc. quietly keep the economy humming.Covid-19 has recast that unassuming role in a more heroic light. When the pandemic history is written, the logistics industry will deserve a volume. “UPS-ers are essential workers,” the U.S. company’s boss Carol Tome told investors recently.Their most important task — quickly and safely delivering billions of doses of a coronavirus vaccine worldwide — still lies ahead. The massive demand and the ultra-cold temperatures required to store some promising vaccine candidates (including the one developed by Pfizer Inc. and BioNTech SE) will provide an unprecedented logistical challenge.Thanks to early preparation and heavy investment, the companies think they’re in good shape to tackle it. Happily for shareholders, the vaccine effort could further juice the industry’s strong recent earnings and share price performance.The logistics groups have been under immense strain, so it’s hard to begrudge them their good fortune. Bulk deliveries were hit early in the pandemic when businesses and factories were closed, so couriers suddenly had to deliver more to residential addresses, which is more expensive. When land borders closed and passenger planes were grounded, the industry was also called upon to get personal protective clothing and ventilators where they were needed.Right now, the companies are focused on saving Christmas. An unprecedented volume of holiday gifts will be purchased online this year. Deutsche Post’s DHL express-delivery unit expects holiday season volumes to be more than 50% higher than in 2019.As housebound populations “buy more stuff,” the big parcel networks have pounced on the golden opportunity, hiring tens of thousands of workers. Most businesses have imposed surcharges on customers to reflect the difficulty of delivering during a pandemic.Because of their large fixed costs, express-delivery networks make more money when more packages flow through them. Deutsche Post’s operating profit jumped by almost half year-on-year in the July to September quarter. The German company expects full-year free cash flow to exceed 2 billion euros ($2.4 billion) and operating profit of up to 4.4 billion euros, a record. Since a March low, its shares have doubled. FedEx’s have almost trebled.Airfreight has become particularly lucrative. Much of the world’s air cargo normally travels in the bellies of passenger jets, which have been grounded. Deutsche Post and FedEx benefit from their absence because each company owns hundreds of dedicated airfreighters. Shipping an estimated 10 billion doses of the vaccine will make yet more demands of airfreight, requiring some 15,000 flights over the next two years, Deutsche Post estimated in a recent study.(1)Some potential vaccines will need to be stored at very low temperatures, which plays to the strengths of big logistics providers. UPS has invested in two giant “freezer farms” in Kentucky and the Netherlands, capable of storing millions of doses at temperature as low as -80 Celsius. FedEx has more than 90 cold chain facilities worldwide and plans more.Coupled with the existing shortage of airfreight capacity, the exacting handling requirements could inflate shipping costs. Detlef Trefzger, chief executive officer of Kuehne + Nagel International AG, a big freight forwarder, said recently that his company wasn’t a government body and therefore the market rate “will be applicable.” Berenberg analysts say vaccine delivery could create a period of “supernormal” profits in logistics. In theory, once a vaccine is widely available, the favorable pricing dynamics supporting the industry will normalize somewhat. Deutsche Post, FedEx and UPS shares fell on Monday, even as the stock market surged.However, the e-commerce shift is likely to be permanent, and analysts say airfreight markets could remain tight for at least a couple more years. If a vaccine leads to increased trade flows, the logistics groups will benefit.As with Amazon.com Inc., the delivery industry risks a backlash if it’s seen to profit excessively from the pandemic. But if vaccines are delivered safely and our holiday gifts arrive on time, the companies will have earned our gratitude, and a commensurate reward.(1) The 10 billion dose estimate is based on 70% of the global population requiring vaccination to achieve herd immunity, and an average of 1.8 doses per recipient.This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.Chris Bryant is a Bloomberg Opinion columnist covering industrial companies. He previously worked for the Financial Times.For more articles like this, please visit us at bloomberg.com/opinionSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,