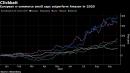

(Bloomberg) — While Amazon.com Inc. and its FANG cohort have grabbed the headlines, some of the biggest stock-market winners in Europe during the coronavirus pandemic may be companies you’ve never heard of.Investors seeking stellar returns have been snapping up shares of small companies that range from e-commerce merchants to mobile-game makers. Shares of German retailers Westwing Group AG and Home24 SE and Sweden’s Lyko Group AB and Boozt AB have more than doubled this year, outpacing Amazon’s gain of about 70%. Away from retail, LoopUp Group Plc, which makes software for video conference calls, and game maker G5 Entertainment AB also have soared.“Small caps can be quite agile in an environment where things are changing quite quickly,” Hywel Franklin, head of European equities at Mirabaud Asset Management Ltd., said in an interview. “Thinking about what the new normal looks like, it’s clear that some of the companies which are best placed for that will also be in the small-cap area.”In e-commerce, analysts at Sanford C. Bernstein Ltd. predict that online spending growth next year will return to pre-Covid levels. The real benefit of the one-time boost during the pandemic will be in giving companies three to four years’ worth of scale in a year, according to analyst Aneesha Sherman. Whether the shares’ outperformance will continue is another matter.“Investors are questioning whether they should take profits at current levels,” Sherman said. “I think it depends heavily on the company — which stocks have signs of long-term quality in the underlying growth versus which are riding the wave of the tech rally.”Here’s a round-up of some European small-cap stocks with an online focus that have benefited from the pandemic, with year-to-date stock performance:Westwing, up 448%Munich-based Westwing, which sells furniture and home accessories, has a market value of about 400 million euros ($468 million). Startup investor Rocket Internet has pared its stake in the company to about 25% now from 32% prior to its IPO in October 2018. Westwing raised its full-year revenue forecast last month, with Citigroup noting its royalty model should help sales and profit. The bank has a neutral rating on the shares, while the other three firms that follow the stock have buy recommendations.Lyko, up 354%Lyko, with a market value of 6.1 billion kronor ($685 million), operates salons and sells more than 55,000 hair care and beauty products online. The company listed in Stockholm in December 2017 and parent company Lyko Holding owns about half of the shares. Sales soared 58% in the second quarter, with online sales growing 99%.Boozt, up 138%Boozt listed in May 2017 and sells clothes, shoes and bags on its website. The Swedish company added more than 300,000 customers across the Nordic region during the first few months of the coronavirus pandemic, it said in August. Analysts see little upside for Boozt, which has a market value of 7.4 billion kronor: Their average price target is only about 3.3% above where the stock’s now trading.Home24, up 181%Germany’s Home24, which went public in June 2018, sells furniture online and is backed by Kinnevik AB, the largest shareholder in Zalando SE. Sales jumped 49% excluding currency swings in the second quarter, helping the retailer post its most profitable quarter ever and leading it to raise its growth forecast for the year.LoopUp, up 192%LoopUp has benefited as the pandemic has forced employees to work from home, though the share price rally hasn’t been as extreme as Zoom Video Communications Inc.’s in the U.S. “At a high level, we’ve seen accelerated growth in our business and we’re very lucky to have benefited from the migration towards wider-scale working from home with the Covid pandemic,” LoopUp co-CEO Steve Flavell said in a telephone interview. The two analysts who follow the stock both have buy ratings and see the rally continuing. LoopUp has a market value of 124.6 million pounds ($161 million).G5 Entertainment, up 266%Shares of G5 Entertainment AB have soared as people turned to its free-to-play mobile puzzle and adventure games to keep them entertained during lockdowns. Revenue rose 27% in the second quarter and the average number of monthly active users increased 13%. The stock has risen an average of 40% a year since the company went public in Sweden in 2006, giving it a market value of 3.4 billion kronor.Best Of The Best, up 379%Best Of The Best Plc organizes online competitions, with prizes including cars, cash, holidays, bikes and watches. The London-listed company, which has a market value of 161.8 million pounds, in June said it’s starting a formal sale process after receiving a “heightened level of interest” following full-year results that included an increase in revenue and profit.For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,