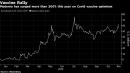

(Bloomberg) — Bearish investors are holding on to their short bets on Moderna Inc. even as the biotech’s market value swelled by more than $25 billion this year on optimism its experimental messenger-RNA vaccine will play a part in tamping down the pandemic.Options data suggest the stock is ready for another double-digit swing over the next few weeks and with S3 Partners data showing about $1.84 billion shares shorted, bears might face fresh pain or finally claw back some losses.Moderna “was and is now a short squeeze candidate,” Ihor Dusaniwsky, S3’s managing director of predictive analytics, said in an interview.The company is expected to have an interim early look this month at how effective its shot, mRNA-1273, is at preventing Covid-19. Results on Monday from Pfizer Inc. and BioNTech SE’s vaccine offered both boon and bane to Moderna. The shot set a high bar for the competition as a first look at their late-stage study showed more than 90% effectiveness is preventing symptomatic infections. At the same time, vaccine similarities bode well for Moderna.Options indicate shares could move 16% in either direction by the end of November and 27% if looking further out to Dec. 24. Moderna has soared more than 300% this year. If the stock rallies further, bearish traders may have to buy up the stock to prevent more losses on their short bets. The short sellers have already been feeling the pinch and some cut their losses after the stock reached a peak in July. Short bets around the time topped out at $2.4 billion, according to S3 data.“This has not been a profitable trade for short sellers as they are down $1.27 billion in year-to-date mark-to-market losses, including $209 million” so far in November, Dusaniwsky said. If Moderna’s stock fell by 27%, shortsellers could recoup $486 million of their losses, he said.Moderna remains the largest short bet in the biotech sector, followed by Amgen Inc. and another Covid-tied name, Gilead Sciences Inc.Daytrader EffectStay-at-home daytraders bolster many Covid-19 plays and — for Gilead at least — were quick to step aside once a commercial reality approached. Gilead’s stock peeled off more than 20% since a May 1 clearance for its Covid-19 treatment.While Pfizer and Moderna are leading the pack, there are at least 11 late-stage studies underway including large-scale trials from AstraZeneca Plc and Johnson & Johnson. Moderna shares jumped as much as 9.3% in New York Wednesday to $83.10, the highest since late July.“Given the competitive nature of Covid-19 vaccines (there could be many) and the uncertain duration of pandemic, we believe that the market is already ascribing a substantial amount of value to these vaccines, leaving us cautious on the ultimate opportunity,” JPMorgan analyst Cory Kasimov cautioned clients in a research note after Pfizer and BioNTech results.Infection TriggersFor Moderna’s shot, an interim analysis will be triggered after 53 volunteers from its roughly 40,000-person study come down with a Covid-19 infection. The participants are split between those vaccinated and those getting a placebo, and volunteers will be followed for a safety analysis. A second analysis will occur after 106 infections. That might not take long with new infections accelerating and hitting a record in the U.S.Pfizer’s shot is expected to have a required two months of safety data next week, which — if all turns out well — could get some high-risk individuals vaccinated in December, according to Anthony Fauci, the nation’s top infectious disease expert.While the U.S. has signed Pfizer up for 100 million doses and an option for another 500 million, the country will need more than one vaccine to head off the Covid tide. And Moderna, back in August, signed a 100 million dose deal with the government.Monday’s data from Pfizer grabbed the market’s attention, fueling a stock market rally that faded after investors began to contemplate the distribution logistics and how many vaccine-skeptical Americans will actually take it. And there is yet to be a full picture on safety or how long shots will be effective.(Adds short interest details and commentary starting in second paragraph, updates shares.)For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,