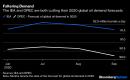

(Bloomberg Opinion) — Oil producers could be set for another showdown before the end of the year, with heavyweights Saudi Arabia and Russia holding different views on how to approach the halting recovery in oil demand.Renewed restrictions on travel and social gatherings across Europe, along with the tapering of state support packages for companies, are having a chilling effect on demand for crude, just as the OPEC+ group of oil producers, who cut production by a record 9.7 million barrels a day in May, begin to contemplate the next easing of limits on their output. We should all remember what happened last time they couldn’t agree on what to do. The International Energy Agency and the Organization of Petroleum Exporting Countries have both resumed cutting their forecasts for this year’s oil demand. In the past two months, the IEA has trimmed its forecast by 400,000 barrels a day, while OPEC has reduced its own by 500,000 barrels. And they may have further yet to fall. Neil Atkinson, the IEA’s Head of Oil Industry and Markets Division, said at a Bloomberg event on Thursday that the agency is “more likely to make a downgrade than an upgrade” to demand forecasts in its next monthly report.The biggest headwind to oil demand comes from reduced trade, weakened economies and the knock-on effects of business closings and job losses, Standard Chartered analysts, including Emily Ashford and Paul Horsnell, said in a report last week.At a time when oil demand was meant to be recovering, it now seems to be going into reverse again. A new round of work-from-home advice and restrictions on social activities, triggered by a rise in virus infections in Europe, are set to collide with a reduction in economic support measures. U.S. oil consumption faces similar obstacles, with government support under the Coronavirus Aid, Relief, and Economic Security Act coming to an end on September 30. Even Asia isn’t immune, with Thailand the only country that’s close to seeing a V-shaped recovery in oil demand, according to Standard Chartered.Of course, it’s not all about demand. The room available for additional supply from the OPEC+ countries also depends on how much oil is coming from elsewhere. And there is at least as much uncertainty on this front as there is with demand.There are fears — or hopes, if you’re a rival oil producer — that output from U.S. shale deposits is set for another big drop in the coming weeks and months. Well completions in the U.S. are now so low that large monthly declines in production may be imminent, Emily Ashford warned last week. More robust monthly data from the U.S. Energy Information Administration show that this year’s drop in domestic crude production has been both steeper and deeper than their preliminary weekly data suggested. Another drop in U.S. production would leave more room for the OPEC+ group to raise its own output.But there are problems within the group itself, as I wrote here. While overall compliance with the promised output cuts has been unusually good — thanks in part to the no-nonsense attitude of Saudi Arabian energy minister Prince Abdulaziz Bin Salman — a few countries are still struggling to implement their cuts in full.And then there’s Libya, which remains outside the group’s supply deal and is creating another big source of uncertainty. The political truce in the OPEC member’s long-running civil war could allow it to boost exports, adding to global supply at an inconvenient time for the rest of the group. The state oil company is predicting supply could quickly rise to 260,000 barrels per day from about a third of that level. Goldman Sachs reckons exports could reach double that by the year’s end.Even the world’s biggest oil traders — including Vitol Group, Trafigura Group and Mercuria Energy Group — don’t have a united view on the outlook for oil over the coming months. Mercuria co-founder and CEO Marco Durnand says “we do not need the extra oil” that the OPEC+ group is planning to pump from January. Trafigura executives are also downbeat. But Vitol has a starkly more bullish view than its rivals. With so much uncertainty, it’s little surprise that tensions are emerging within the OPEC+ group.Saudi Arabia wants, above all, to prevent oil prices from slipping, and its energy minister says the OPEC+ producer group will be “proactive and preemptive” to stop supply from running ahead of demand. He wants to make oil traders “as jumpy as possible.” His Russian counterpart Alexander Novak is more cautious, wanting to avoid repeatedly revising a deal that sets out production targets to the end of April 2022. That agreement sees the group adding another 2 million barrels a day to their collective production from the beginning of January (see the chart above), and Novak prefers to wait as long as possible before making a decision to alter that.We’ve all seen where a standoff between the two big beasts of the OPEC+ group can lead. There was a similar disagreement back in March, with Russia wanting to preserve the status quo and Saudi Arabia seeking deeper output cuts, that sparked a brief production free-for-all that helped push oil prices below $20 a barrel. Nobody wants a repeat of that.This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.Julian Lee is an oil strategist for Bloomberg. Previously he worked as a senior analyst at the Centre for Global Energy Studies.For more articles like this, please visit us at bloomberg.com/opinionSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,