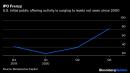

(Bloomberg Opinion) — In a hot market for new technology stocks, it was Palantir Technologies Inc.’s turn in the spotlight on Wednesday. The debut wasn’t a complete show-stopper, and that’s fine — not everything can, or should, be a market darling. The data-mining company, co-founded by billionaire and Donald Trump supporter Peter Thiel, went public through a direct listing and started trading at $10, above the New York Stock Exchange’s $7.25 reference price. A $10 price equates to a market value of about $22 billion on a fully diluted basis, which, while respectable, isn’t much higher than its last private fund-raising round in 2015 at $20 billion. Palantir traded as high as $11.42 on Wednesday before drifting back under $10 to close at $9.50.Investors have been clamoring for new tech listings despite high stock valuations and the potential dampening effect of a second-wave virus outbreak. According to Renaissance Capital, the U.S. IPO market is on track to have its most active third quarter since the dot-com era two decades ago, with nearly 80 deals set to raise about $29 billion in total. One offering earlier this month — the fast-growing data-warehousing company Snowflake Inc. — skyrocketed from the start and has already more than doubled in price, making a tidy paper profit for investors including Warren Buffett’s Berkshire Hathaway Inc. Palantir’s more muted reception shows investors can be discerning even in frothy times. (Another tech direct listing, Asana Inc., also began trading above its reference price on Wednesday, settling in at about $29 after opening at $27.)Palantir was initially formed to help government intelligence and military agencies automate their surveillance capabilities and has since expanded to assist companies in combing through data for business insights. The company’s name comes from the crystal ball used in J. R. R. Tolkien’s “Lord of the Rings,” but management may have a hard time selling investors on its vision of the company’s prospects.Ahead of the listing this month, Palantir executives gave a rosy financial outlook, forecasting about $1 billion in sales and an adjusted operating profit excluding stock-based compensation for this year — a first after more than a decade of large annual losses. They also project robust revenue growth of more than 30% next year as well. Further confirmation of this upbeat line came late Tuesday, when the Defense Department announced it awarded a $91 million contract to Palantir for the Army Research Laboratory.Palantir, though, may be underestimating the potential impact of the dramatic changes underway in the cultural and political environment following this year’s wave of nationwide protests over racial injustice. The company’s clientele has included several city police departments and the Department of Homeland Security, according to Bloomberg News, and scrutiny over the use of its data-mining software by federal and local law enforcement agencies is certain to rise on the back of privacy and profiling discrimination concerns. To illustrate, on Monday Amnesty International criticized Palantir’s work with Immigration and Customs Enforcement, saying there was “high risk” its software may be contributing to human rights violations of migrants and asylum-seekers. Palantir didn’t respond to a request for comment on the report.The November presidential election could also have serious consequences for Palantir. In late August, when it first filed for a stock listing, I noted at the time that the company explicitly warned in its prospectus that changes in “agency leadership positions in connection with the 2020 presidential election” may hurt its business. It’s easy to see how any tailwinds from having a Trump supporter as co-founder could easily turn into headwinds with a Trump loss.That wouldn’t be ideal for Palantir as the government segment is still a critical driver for its growth. Last year, the company’s sales to government entities accounted for about half of its revenue and grew at more than double the rate of its commercial business. And then there is customer concentration risk. While best-in-class cloud software firms like Snowflake have a diverse array of thousands of customers, Palantir’s client base totals just 125, with the largest 20 customers accounting for two-thirds of its revenue last year. Losing one or two key customers would be a significant blow to its financials. So with Joe Biden rising in the polls against Trump, it becomes increasingly problematic for Palantir’s prospects. A Democratic administration will likely have far different funding priorities and civil liberty guidelines for government programs compared with the current one. The next four years may be far more difficult even for a company named after an all-seeing magical stone.(The second paragraph was updated with Palantir’s closing price.)This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.Tae Kim is a Bloomberg Opinion columnist covering technology. He previously covered technology for Barron’s, following an earlier career as an equity analyst.For more articles like this, please visit us at bloomberg.com/opinionSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,