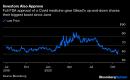

(Bloomberg Opinion) — Gilead Sciences Inc.’s remdesivir, now under the brand name Veklury, reached another milestone Thursday. It is now the first medicine to get full Food and Drug Administration approval to treat Covid-19. Investors seem to see the nod as a boost to the drug’s prospects, sending shares up more than 4% in early trading Friday after a recent slump. The agency’s decision isn’t likely to dramatically expand the use of the medicine, which has been available to patients through emergency use authorization since May. The data surrounding its modest benefit has become muddier, and it’s not clear why the FDA felt a more formal approval was needed, nor is it obvious that it should have granted one.Veklury’s full approval is based on three studies, the most important of which is a placebo-controlled trial run by the National Institutes of Health. It found that the drug sped recovery for patients by about five days but did not clearly reduce the risk of dying. But the FDA essentially ignored crucial new data about the medicine. A massive study from the World Health Organization released earlier this month found Veklury fails to prevent deaths or substantially improve outcomes. There are fair criticisms of the trial, which wasn’t double-blinded, gathered data from many different countries, and wasn’t designed to look directly at whether the drug speeds recovery. The FDA says it’s this last factor that led it to feel comfortable with its approval decision.The WHO study, though, was larger than the one the FDA focused on and looks at how Veklury is used in the real world. The lack of benefit adds to existing concerns about the drug’s true utility. It’s still unclear when the medicine is most useful or what patients it’s best suited to help. Medical experts aren’t just skeptical of Thursday’s decision; they had already registered concerns about the FDA’s August decision to expand the drug’s emergency use long before the WHO results. Formal approval will let Gilead promote the drug, which it couldn’t under its initial authorization. But it won’t erase those doubts, and rosy porjections of multibillion-dollar sales may be too optimistic.At the very least, the new results call Gilead’s $3,120 price tag into question. The Institute for Clinical and Economic Review, an independent drug pricing review group, said over the summer that a reasonable price for the drug was $2,520 to $2,800 per course when accounting for the availability of dexamethasone, a cheap steroid that does reduce the risk of death in severely ill Covid patients. With no mortality benefit, its assessment of a fair price for Veklury drops to $310. The FDA might have addressed some of these issues and built confidence in both the drug and its process if it had held a public meeting of experts to discuss full approval. It holds such panels routinely for other medicines and did so Thursday to discuss standards for Covid vaccines.Approval in that environment or with the backing of new and better data might have been grounds for real optimism. Instead, investors may be over-celebrating what looks like a rubber stamp. This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.Max Nisen is a Bloomberg Opinion columnist covering biotech, pharma and health care. He previously wrote about management and corporate strategy for Quartz and Business Insider.For more articles like this, please visit us at bloomberg.com/opinionSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,