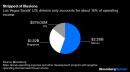

(Bloomberg Opinion) — No one ever said that the casino industry didn’t involve risky bets. Sheldon Adelson, the billionaire founder of Las Vegas Sands Corp., is considering a $6 billion sale of the Nevada casinos that made his fortune, people familiar with the matter told Gillian Tan and Christopher Palmeri of Bloomberg News.That’s a gutsy move. The casino industry is in the grip of a record slump. Gaming revenues on the Las Vegas Strip were down 39% from a year earlier in August. In Macau, where Sands China Ltd.’s resorts accounted for 61% of its parent’s operating income last year, the year-on-year fall in casino gambling revenues was 90% last month. Singapore, whose Marina Bay Sands hotel forms the third leg of Adelson’s empire, has been closed off to the outside world by coronavirus and is only slowly recovering. After such a run of bad cards, isn’t this a moment to stand pat?Things aren’t playing out that way. Indeed, if anything, Adelson is upping the stakes on a strategy that’s sustained Las Vegas Sands for its 16-odd years as a listed company: betting larger and larger sums on his Asian operations in the hope that returns from the properties will outstrip anything available in Nevada.There are substantial drawbacks involved in that approach right now. The Macau casinos are entirely dependent upon licenses due to expire in 2022. The territory’s government has yet to release details of requirements for license renewals, and there are enormous political risks inherent in the process. Macau is caught in the crossfire of a deteriorating U.S.-China relationship. Thanks to their Macanese resorts, Las Vegas Sands and fellow Vegas mainstay Wynn Resorts Ltd. have the biggest exposure to China and its territories among members of the S&P 500.(1) Macau’s government has long orbited closer to Beijing than Hong Kong ever did, and any vestiges of independence are being squeezed out under President Xi Jinping’s drive to integrate the two territories with mainland Chinese cities as a unified Greater Bay Area megalopolis. Adelson, meanwhile, is politically exposed as one of the most substantial donors to President Donald Trump, China’s leading antagonist in the trade war. A bet that Sands’s licenses will be renewed without extracting crippling penalties is a wager that the diplomatic wildfire razing so many aspects of the U.S.-China trading relationship will leave Macau untouched.Singapore isn’t without problems, either. A lawsuit by a gambler at Marina Bay Sands last year has resulted in a police investigation into how the casino handles players’ money, calling attention to its relationship with the junket operators who provide finance and travel arrangements to bring in high-rolling gamblers.While Singapore’s casino regulator has already closed its investigation, that license is also up for renewal in 2022. Any adverse finding from the police probe or problems renewing its Macau license would complicate efforts to show that Sands has the ethical and financial capacity to keep operating its Singapore gaming floors.One way of spreading those sorts of risks would involve diversifying. Until recently, you could have argued Las Vegas Sands was doing this. Alongside its original core business in Nevada, the company was looking to build a $10 billion resort in Japan as that country opened up its gambling market — but Adelson walked away from that in May.Adelson himself is 87 years old, owns 52% of the company, and was treated last year for non-Hodgkin’s lymphoma. A changing of the guard wouldn’t necessarily be a disaster. Chief Operating Officer Robert Goldstein and Chief Financial Officer Patrick Dumont have long experience managing the company, and if anything, a Las Vegas Sands without Adelson’s close association with Trump may have an easier time of it in Macau. Still, mogul-run casinos carry a fair amount of “key person risk.” Wynn Resorts, whose founder Steve Wynn stepped down as chief executive officer in 2018 after reports in the Wall Street Journal about sexual harassment of employees, has trailed the performance of its rivals ever since.Most importantly, nothing changes the fact that a casino empire focused on four separate jurisdictions just 12 months ago is now looking to place all its chips on two. You can take Adelson’s decision to double the stakes in Macau and Singapore as a sign of his confidence that he holds all the cards, but in truth even he doesn’t know which way the regulators will go. Investors wagering on Sands’s next chapter should remember that, for a skilled player, a strong hand and a bluff can look exactly the same. (1) MGM Resorts International is in a similar position, but its Macau operation is considerably smaller as a share of the group.This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.David Fickling is a Bloomberg Opinion columnist covering commodities, as well as industrial and consumer companies. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian.For more articles like this, please visit us at bloomberg.com/opinionSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,