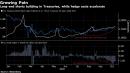

(Bloomberg) — Rates traders are starting to question the big short position that’s built up in long-maturity Treasuries on the expectation of a Democratic sweep in next month’s U.S. elections.In the market for options on Treasury futures, trades emerged in the past week that wager against a leap in volatility or a major breakout in yields heading into year-end. Specifically, they benefit from 10-year rates being capped around 1%, less than 20 basis points above current levels. Some popped up Friday, after the final presidential debate.The positions lean solidly against the prevailing narrative, fueled by polling suggesting the Democrats may take both the White House and the Senate, allowing them to pass significant fiscal stimulus that jumpstarts the economy’s rebound from the pandemic. If these options traders are right, Treasuries could face a sharp reversal. Leveraged investors have never had a bigger bet on losses in bond futures. In the cash market, 10-year yields set a four-month high on Friday before retreating. But some traders see room for a contrarian take.“It’s now such a common narrative that there will be a Blue Wave and that there’ll be an enormous amount of stimulus and it will be inflationary,” said Peter Chatwell, London-based head of multi-asset strategy at Mizuho International Plc. But with a different electoral outcome, or even if polling starts to shift before the vote, “that could see some investors piling back into Treasuries.”Ten-year yields rose about 10 basis points this past week, the most since August, ending at 0.84%. Thirty-year yields increased even more, by about 11 basis points to 1.64%, driving the spread over 5-year yields to the steepest since 2016.Eye-Popping GDPIn the coming week, one highlight is a report expected to show that the economy rebounded at an eye-popping 31.8% annual pace last quarter as businesses started to reopen. A larger-than-forecast figure could pressure yields higher, opening up the risk of mortgage-related hedging that exacerbates the selloff.Granted, market participants expect that the Federal Reserve would act to avert a significant jump in yields that roils markets, no matter who emerges victorious in November.But as yields have climbed this month, there’s been a sustained increase in open interest in bond futures, an indication that fresh short positions have been fueling the move. As of Thursday, the amount of open interest in the bond futures contract was the most in two months. And in Treasury bond options, demand for hedging against a jump in yields over the next month reached the highest since March, before easing over the past few days.Against that backdrop, the past week’s options trades stood out. One, with a $20 million premium, expressed conviction that an increase in 10-year yields will stall ahead of 1%. Another wagers that traders are paying too much to hedge against higher yields.See here for further details about this week’s two big Treasury option wagersWith a contested election still a possibility, the market may have to be patient to find out which side is right. And as virus cases surge anew, the fate of the steepener trade may not even come down to the Nov. 3 vote.What to WatchThe economic calendar:Oct. 26: Chicago Fed national activity index; new home sales; Dallas Fed manufacturing activityOct. 27: Durable, capital goods orders; FHFA house price index; S&P CoreLogic home-price data; Conference Board consumer confidence; Richmond Fed manufacturing indexOct. 28: MBA mortgage applications; advance goods trade balance; wholesale inventories; retail inventoriesOct. 29: Weekly jobless claims; GDP; Bloomberg consumer comfort; pending home salesOct. 30: Personal income, spending; PCE deflator; employment cost index; MNI Chicago PMI; University of Michigan sentimentThe Fed calendar:Oct. 28: Dallas Fed’s Robert Kaplan moderates panel with former Bank of England Governor Mark CarneyThe auction calendar:Oct. 26: 13-, 26-week billsOct. 27: 2-year notesOct. 28: 2-year floating-rate notes; 5-year notesOct. 29: 4-, 8-week bills; 7-year notesFor more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,