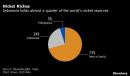

(Bloomberg) — Contemporary Amperex Technology Co. Ltd. and LG Chem Ltd., two of the world’s top producers of batteries for electric vehicles, have signaled they may join projects that could see $20 billion more invested in supply chains in Indonesia, according to the country’s government.The firms signed separate heads of agreement with Aneka Tambang Tbk last month aimed at manufacturing higher value products for batteries from the state-owned miner’s nickel output, said Septian Hario Seto, deputy for investment coordination and mining at the coordinating ministry for maritime affairs and investments.It’s a strategy that would involve development of new capacity for metals processing to battery pack assembly, according to Seto. “This is a race on technology,” he said in an interview. “LG Chem and CATL are two front-runners in lithium battery technology.”Indonesia holds almost a quarter of global reserves of nickel, a key metal for electric cars, and is seeking to use that advantage, along with cheap power prices and low-cost manufacturing, to build a domestic battery industry.LG Chem and Aneka Tambang have agreed to explore joint venture options, though the plan is at a very early stage, a spokesperson for the South Korean battery maker said. A full agreement would help provide LG Chem with stable access to nickel, according to the company.China’s CATL, already part of a consortium building a nickel processing plant and other battery supply chain infrastructure in central Sulawesi, declined to comment. Aneka Tambang is examining cooperation with third parties, and studying plans to develop a downstream industry for nickel ores, the firm said.Projects worth more than $30 billion have already been announced under Indonesia’s bid to become a hub for production of battery materials, the packs themselves and electric vehicles, including existing commitments from LG Chem and CATL. Additional investments would offer further support to President Joko Widodo’s ambition of developing the country as a key regional center in the industry.Read more: Indonesia Will Trade Nickel Riches for an Electric-Car IndustryFirms including PT Indonesia Asahan Aluminium, known as Inalum, and state power producer PT Perusahaan Listrik Negara will collaborate under the Indonesia Battery holding company. That business will produce lithium-ion cells and work with Aneka Tambang and others, Inalum President Director Orias Petrus Moedak said Tuesday.The nation’s lack of existing lithium-ion battery production makes the task of developing an end-to-end EV industry more challenging, while Indonesia ranks behind some neighboring countries on research and development spending, according to Allan Ray Restauro, an analyst with BloombergNEF. More needs to be done to stimulate local demand for electric vehicles, he said in an April report.Existing efforts to lift production of nickel materials for batteries through development of four high pressure acid leaching sites — plants that’re able to convert Indonesia’s lower quality ores into battery-grade chemicals — are advancing, Seto said in the interview last week. At least one of the plants could begin production before the end of next year, if environmental approval and waste management plans are completed, he said.For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.,

,